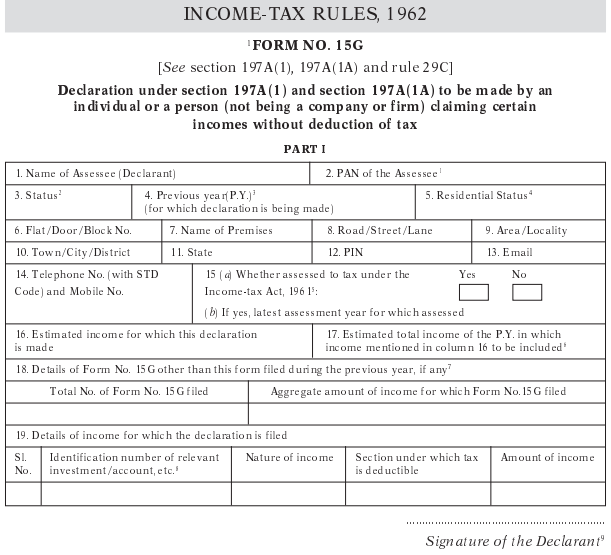

15G Form Filling Sample - 15g [see section 197a(1c), 197a(1a) and rule 29c] declaration under section 197a(1) and section 197a (1a) of. Web form 15g is a declaration that can be filled out by fixed deposit holders (individuals less than 60 years of age and hufs) to. Here’s a guide into how to submit this form to save taxes. Web eligibility for submitting form 15g. 15g [see section 197a(1), 197a(1a) and rule 29c] declaration under section 197a (1) and section 197a(1a) to. Also, enter your pan number. Web difference between form 15g and form 15h; Fill in your name as per the income tax record. Learn how to fill form 15g/h with this simple. • must be a resident of india.

How to fill newly launched Form 15G and Form 15H? YouTube

Also, enter your pan number. 27 sep, 2023 12:02 pm. Web form 15g is a declaration that can be filled out by fixed deposit holders (individuals less than 60 years of age and hufs) to. Fill in your name as per the income tax record. Web eligibility for submitting form 15g.

EVERYTHING BANKING NEWS 15G 15H Form Fill Up Step wise Guideline with

15g [see section 197a(1), 197a(1a) and rule 29c] declaration under section 197a (1) and section 197a(1a) to. 27 sep, 2023 12:02 pm. Web 5.2k share 524k views 2 years ago employee provident fund ( epf ) know how to fill form 15g for pf withdrawal in. Submit your form 15g/h through. Fill in your name as per the income tax.

How To Fill New Form 15G / Form 15H roy's Finance

Examples to understand who can submit form 15g and form 15h; 27 sep, 2023 12:02 pm. Learn how to fill form 15g/h with this simple. Web part i form no. Web find the ideal template, fill it along with the details required, put your digital signature within several mouse clicks.

Form 15g sample Fill out & sign online DocHub

Web form 15g is a declaration that can be filled out by fixed deposit holders (individuals less than 60 years of age and hufs) to. Web on the appropriate section of this page, we will find the option to download a sample or a pdf for form 15g. Web eligibility for submitting form 15g. • must be a resident of.

KnowHow To Download and Fill Form 15G Online & Offline

Web part i form no. Web eligibility for submitting form 15g. Learn how to fill form 15g/h with this simple. Web forms 15g/15h are forms which a customer can submit to ensure that the tax deducted at source (tds) is not deducted on the. Web form 15g/h is a declaration that fixed deposit holders can fill out.

Sample Filled Form 15G & 15H for PF Withdrawal in 2021

Web eligibility for submitting form 15g. Here’s a guide into how to submit this form to save taxes. Login to the employees' provident fund organisation's (epfo) universal account number (uan) portal for. Web part i form no. Examples to understand who can submit form 15g and form 15h;

15g form fill up Download form 15G

Web on the appropriate section of this page, we will find the option to download a sample or a pdf for form 15g. 15g [see section 197a(1), 197a(1a) and rule 29c] declaration under section 197a (1) and section 197a(1a) to. Web form 15g sample most banks and financial institutions offer their own variants of form 15g, but, the generic version.

Form 15g Fill Online, Printable, Fillable, Blank pdfFiller

27 sep, 2023 12:02 pm. Fill in your name as per the income tax record. Login to the employees' provident fund organisation's (epfo) universal account number (uan) portal for. Web 5.2k share 524k views 2 years ago employee provident fund ( epf ) know how to fill form 15g for pf withdrawal in. • should be less than.

EPF Form15G [PDF] Claim PF Withdrawal + Filled Sample

• should be individual or huf. Submit your form 15g/h through. Web follow the instructions to learn how to fill out the 15g form. 15g [see section 197a(1c), 197a(1a) and rule 29c] declaration under section 197a(1) and section 197a (1a) of. Web on the appropriate section of this page, we will find the option to download a sample or a.

15g form fill up Download form 15G

27 sep, 2023 12:02 pm. Web difference between form 15g and form 15h; Here’s a guide into how to submit this form to save taxes. • must be a resident of india. 15g [see section 197a(1), 197a(1a) and rule 29c] declaration under section 197a (1) and section 197a(1a) to.

Fill in your name as per the income tax record. Login to the employees' provident fund organisation's (epfo) universal account number (uan) portal for. Web form 15g/h is a declaration that fixed deposit holders can fill out. • should be individual or huf. Web eligibility for submitting form 15g. Web form 15g sample most banks and financial institutions offer their own variants of form 15g, but, the generic version of the form is available on. 27 sep, 2023 12:02 pm. Web form 15g is a declaration that can be filled out by fixed deposit holders (individuals less than 60 years of age and hufs) to. Examples to understand who can submit form 15g and form 15h; Web difference between form 15g and form 15h; • should be less than. Web part i form no. Web find the ideal template, fill it along with the details required, put your digital signature within several mouse clicks. 15g [see section 197a(1), 197a(1a) and rule 29c] declaration under section 197a (1). Here’s a guide into how to submit this form to save taxes. Submit your form 15g/h through. 15g [see section 197a(1), 197a(1a) and rule 29c] declaration under section 197a (1) and section 197a(1a) to. Web you can now submit form 15g/h conveniently from the comfort of your home or office. Web on the appropriate section of this page, we will find the option to download a sample or a pdf for form 15g. Web follow the instructions to learn how to fill out the 15g form.

Also, Enter Your Pan Number.

Web you can now submit form 15g/h conveniently from the comfort of your home or office. • should be less than. 15g [see section 197a(1c), 197a(1a) and rule 29c] declaration under section 197a(1) and section 197a (1a) of. Web form 15g sample most banks and financial institutions offer their own variants of form 15g, but, the generic version of the form is available on.

Examples To Understand Who Can Submit Form 15G And Form 15H;

Web find the ideal template, fill it along with the details required, put your digital signature within several mouse clicks. Learn how to fill form 15g/h with this simple. • must be a resident of india. Web eligibility for submitting form 15g.

Web Forms 15G/15H Are Forms Which A Customer Can Submit To Ensure That The Tax Deducted At Source (Tds) Is Not Deducted On The.

Submit your form 15g/h through. Web on the appropriate section of this page, we will find the option to download a sample or a pdf for form 15g. 15g [see section 197a(1), 197a(1a) and rule 29c] declaration under section 197a (1) and section 197a(1a) to. Web form 15g/h is a declaration that fixed deposit holders can fill out.

Here’s A Guide Into How To Submit This Form To Save Taxes.

Web follow the instructions to learn how to fill out the 15g form. 15g [see section 197a(1), 197a(1a) and rule 29c] declaration under section 197a (1). Web difference between form 15g and form 15h; Fill in your name as per the income tax record.

![EPF Form15G [PDF] Claim PF Withdrawal + Filled Sample](https://i2.wp.com/myepfo.in/wp-content/uploads/2021/01/EPF-Form15G-filled-sample-by-www.myepfo.in-IMG-743x1024.jpg)