4972 Tax Form - However, irs form 4972 allows you to. Taxpayers may use irs form 4972 to calculate the tax on a qualified lump sum distribution using the 20% capital gains. Web mandatory income tax withholding of 20% applies to most taxable distributions paid directly to you in a lump sum from employer retirement plans even if you plan to roll. Web what is irs form 4972 used for?

united states Why do local taxes always have terrible references to

However, irs form 4972 allows you to. Taxpayers may use irs form 4972 to calculate the tax on a qualified lump sum distribution using the 20% capital gains. Web mandatory income tax withholding of 20% applies to most taxable distributions paid directly to you in a lump sum from employer retirement plans even if you plan to roll. Web what.

Form 4972 Tax on LumpSum Distributions (2015) Free Download

Web mandatory income tax withholding of 20% applies to most taxable distributions paid directly to you in a lump sum from employer retirement plans even if you plan to roll. Taxpayers may use irs form 4972 to calculate the tax on a qualified lump sum distribution using the 20% capital gains. However, irs form 4972 allows you to. Web what.

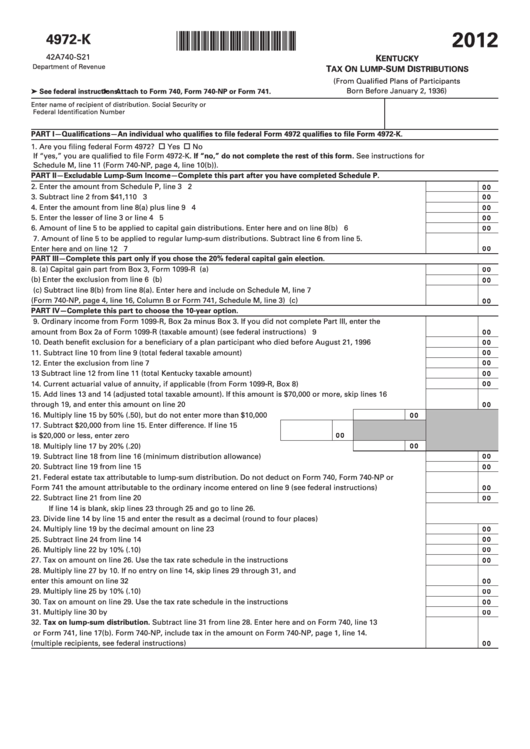

Kentucky Tax On LumpSum Distributions (Form 4972K 1999) printable pdf

Taxpayers may use irs form 4972 to calculate the tax on a qualified lump sum distribution using the 20% capital gains. Web what is irs form 4972 used for? However, irs form 4972 allows you to. Web mandatory income tax withholding of 20% applies to most taxable distributions paid directly to you in a lump sum from employer retirement plans.

Fillable Form 4972K Kentucky Tax On LumpSum Distributions 2012

Web mandatory income tax withholding of 20% applies to most taxable distributions paid directly to you in a lump sum from employer retirement plans even if you plan to roll. Web what is irs form 4972 used for? However, irs form 4972 allows you to. Taxpayers may use irs form 4972 to calculate the tax on a qualified lump sum.

Form 4972 Turbotax Fill Out and Sign Printable PDF Template signNow

Web mandatory income tax withholding of 20% applies to most taxable distributions paid directly to you in a lump sum from employer retirement plans even if you plan to roll. However, irs form 4972 allows you to. Taxpayers may use irs form 4972 to calculate the tax on a qualified lump sum distribution using the 20% capital gains. Web what.

Form SC4972 Download Printable PDF or Fill Online Tax on LumpSum

However, irs form 4972 allows you to. Web what is irs form 4972 used for? Web mandatory income tax withholding of 20% applies to most taxable distributions paid directly to you in a lump sum from employer retirement plans even if you plan to roll. Taxpayers may use irs form 4972 to calculate the tax on a qualified lump sum.

Form 4972 Tax on LumpSum Distributions (2015) Free Download

Web what is irs form 4972 used for? Web mandatory income tax withholding of 20% applies to most taxable distributions paid directly to you in a lump sum from employer retirement plans even if you plan to roll. Taxpayers may use irs form 4972 to calculate the tax on a qualified lump sum distribution using the 20% capital gains. However,.

Form 4972K Download Fillable PDF or Fill Online Kentucky Tax on Lump

Web what is irs form 4972 used for? Taxpayers may use irs form 4972 to calculate the tax on a qualified lump sum distribution using the 20% capital gains. However, irs form 4972 allows you to. Web mandatory income tax withholding of 20% applies to most taxable distributions paid directly to you in a lump sum from employer retirement plans.

2019 IRS Form 4972 Fill Out Digital PDF Sample

Taxpayers may use irs form 4972 to calculate the tax on a qualified lump sum distribution using the 20% capital gains. However, irs form 4972 allows you to. Web what is irs form 4972 used for? Web mandatory income tax withholding of 20% applies to most taxable distributions paid directly to you in a lump sum from employer retirement plans.

Fill Form 4972 Tax on LumpSum Distributions

Web mandatory income tax withholding of 20% applies to most taxable distributions paid directly to you in a lump sum from employer retirement plans even if you plan to roll. However, irs form 4972 allows you to. Taxpayers may use irs form 4972 to calculate the tax on a qualified lump sum distribution using the 20% capital gains. Web what.

However, irs form 4972 allows you to. Web what is irs form 4972 used for? Web mandatory income tax withholding of 20% applies to most taxable distributions paid directly to you in a lump sum from employer retirement plans even if you plan to roll. Taxpayers may use irs form 4972 to calculate the tax on a qualified lump sum distribution using the 20% capital gains.

However, Irs Form 4972 Allows You To.

Web what is irs form 4972 used for? Web mandatory income tax withholding of 20% applies to most taxable distributions paid directly to you in a lump sum from employer retirement plans even if you plan to roll. Taxpayers may use irs form 4972 to calculate the tax on a qualified lump sum distribution using the 20% capital gains.