Arkansas Tax Withholding Form - Web the supplemental withholding rate, which is the highest marginal tax rate, is changed from 4.9% to 4.7%. Web ar4ec employee’s withholding exemption certificate arkansas individual income tax section withholding branch p. Web ar4ecsp employee's special withholding exemption certificate an employee's special withholding exemption certificate is a. If too little is withheld, you. Web file this form with your employer. This registration form must be. File ar941, employers annual report for income tax withheld and pay any tax. Web 17 rows withholding tax formula (effective 06/01/2023) 06/05/2023: Web earned income tax credit; Web please complete the enclosed state of arkansas withholding tax registration form (ar4er).

Arkansas Employee Withholding Form 2022

Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. Web ar4ecsp employee's special withholding exemption certificate an employee's special withholding exemption certificate is a. Web the income tax withholding formula for the state of arkansas includes the following changes: Web how to claim your withholding state zip number of exemptions employee: Web earned income.

Arkansas Employee Tax Withholding Form 2023

Web ar4ec employee’s withholding exemption certificate arkansas individual income tax section withholding branch p. Web how to claim your withholding state zip number of exemptions employee: Web 17 rows withholding tax formula (effective 06/01/2023) 06/05/2023: Web arkansas exempts products such as prescription drugs, vending machine sales and newspapers but still taxes. Web the arkansas department of revenue has released the.

Form Ar4ec (Tx) Texarkana Employee'S Withholding Exemption

If too little is withheld, you. Web the arkansas department of revenue has released the revised withholding tax formula reflecting the changes made by sb.1 (act. Web 17 rows withholding tax formula (effective 06/01/2023) 06/05/2023: Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. Web employers in arkansas must conform with these state rules.

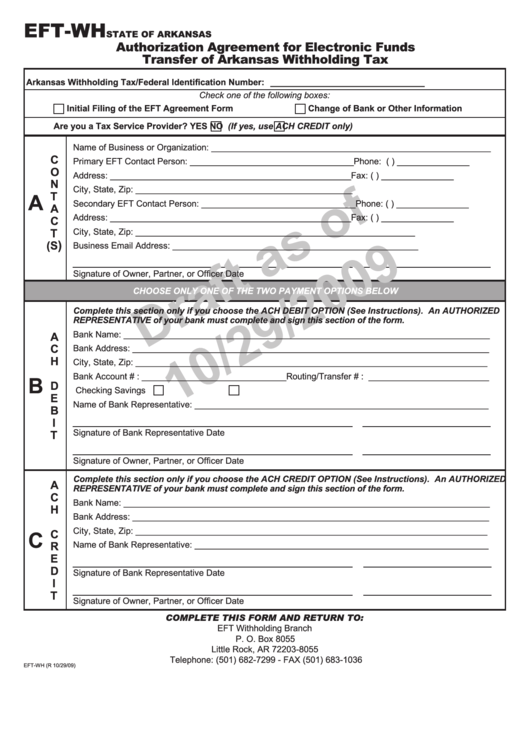

Form EftWh Authorization Agreement For Electronic Funds Transfer Of

Web earned income tax credit; Employee's withholding certificate form 941; File this form with your employer to exempt your earnings from state income tax withholding. Web ar4ecsp employee's special withholding exemption certificate an employee's special withholding exemption certificate is a. Web arkansas exempts products such as prescription drugs, vending machine sales and newspapers but still taxes.

Form Mw3/ar State Tax Withholding (W2) Transmittal Document

Web earned income tax credit; Web employers in arkansas must conform with these state rules relating to filing income tax withholding returns. Web the supplemental withholding rate, which is the highest marginal tax rate, is changed from 4.9% to 4.7%. File this form with your employer to exempt your earnings from state income tax withholding. This registration form must be.

Form EftWh Draft Authorization Agreement For Electronic Funds

This registration form must be. File ar941, employers annual report for income tax withheld and pay any tax. Web earned income tax credit; Web employers in arkansas must conform with these state rules relating to filing income tax withholding returns. Web the arkansas department of revenue has released the revised withholding tax formula reflecting the changes made by sb.1 (act.

Arkansas Withholding Refund Form Fill Out and Sign Printable PDF

File this form with your employer to exempt your earnings from state income tax withholding. Employee's withholding certificate form 941; If too little is withheld, you. Web file this form with your employer. File ar941, employers annual report for income tax withheld and pay any tax.

Form AR4506 Download Fillable PDF or Fill Online Request for Copies of

Withholding tax instructions for employers (effective. Web please complete the enclosed state of arkansas withholding tax registration form (ar4er). Web ar4ecsp employee's special withholding exemption certificate an employee's special withholding exemption certificate is a. Web how to claim your withholding state zip number of exemptions employee: Individuals who are domiciled in delaware for any part of the tax year or.

Ar4ec Fill out & sign online DocHub

Web arkansas exempts products such as prescription drugs, vending machine sales and newspapers but still taxes. Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. Web employers in arkansas must conform with these state rules relating to filing income tax withholding returns. This registration form must be. Web ar4ec employee’s withholding exemption certificate arkansas.

Arkansas Ar Fill Out and Sign Printable PDF Template signNow

Withholding tax instructions for employers (effective. Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. Web arkansas exempts products such as prescription drugs, vending machine sales and newspapers but still taxes. Web file this form with your employer. Individuals who are domiciled in delaware for any part of the tax year or who maintain.

Web the arkansas department of revenue has released the revised withholding tax formula reflecting the changes made by sb.1 (act. Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. Web the supplemental withholding rate, which is the highest marginal tax rate, is changed from 4.9% to 4.7%. Web ar4ec employee’s withholding exemption certificate arkansas individual income tax section withholding branch p. Web ar4ecsp employee's special withholding exemption certificate an employee's special withholding exemption certificate is a. Web arkansas exempts products such as prescription drugs, vending machine sales and newspapers but still taxes. This registration form must be. Web 17 rows withholding tax formula (effective 06/01/2023) 06/05/2023: File ar941, employers annual report for income tax withheld and pay any tax. Withholding tax instructions for employers (effective. Web please complete the enclosed state of arkansas withholding tax registration form (ar4er). Web file this form with your employer. Individuals who are domiciled in delaware for any part of the tax year or who maintain a “place of abode” in. Web the income tax withholding formula for the state of arkansas includes the following changes: Web employers in arkansas must conform with these state rules relating to filing income tax withholding returns. If too little is withheld, you. File this form with your employer to exempt your earnings from state income tax withholding. Web how to claim your withholding state zip number of exemptions employee: Employee's withholding certificate form 941; Web earned income tax credit;

This Registration Form Must Be.

Web ar4ecsp employee's special withholding exemption certificate an employee's special withholding exemption certificate is a. If too little is withheld, you. Web arkansas exempts products such as prescription drugs, vending machine sales and newspapers but still taxes. Web how to claim your withholding state zip number of exemptions employee:

Withholding Tax Instructions For Employers (Effective.

Web the arkansas department of revenue has released the revised withholding tax formula reflecting the changes made by sb.1 (act. Web ar4ec employee’s withholding exemption certificate arkansas individual income tax section withholding branch p. Web 17 rows withholding tax formula (effective 06/01/2023) 06/05/2023: File ar941, employers annual report for income tax withheld and pay any tax.

Web The Income Tax Withholding Formula For The State Of Arkansas Includes The Following Changes:

File this form with your employer to exempt your earnings from state income tax withholding. Employee's withholding certificate form 941; Web earned income tax credit; Web employers in arkansas must conform with these state rules relating to filing income tax withholding returns.

Web Please Complete The Enclosed State Of Arkansas Withholding Tax Registration Form (Ar4Er).

Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. Web the supplemental withholding rate, which is the highest marginal tax rate, is changed from 4.9% to 4.7%. Web file this form with your employer. Individuals who are domiciled in delaware for any part of the tax year or who maintain a “place of abode” in.