Audit Reconsideration Form 4549 - Web the request for audit reconsideration must be made in writing, and you should submit all relevant documentation to support your. Audit reconsideration is a process that allows. The full text and instructions for the irs form 4549 can be found under. This form indicates that the irs doesn’t think you. If you or someone you love is dealing with an irs audit or wants. On the site with all the document, click on begin immediately along with complete for the. Web audit reconsideration is a highly effective tool available to practitioners when a client is not satisfied with the results of. Web if the taxpayer agrees with the balance as proposed on form 4549, the taxpayer can simply sign the form and agree to make. Form 4549, income tax examination changes, is used for cases that result in: The form will include a summary of the proposed.

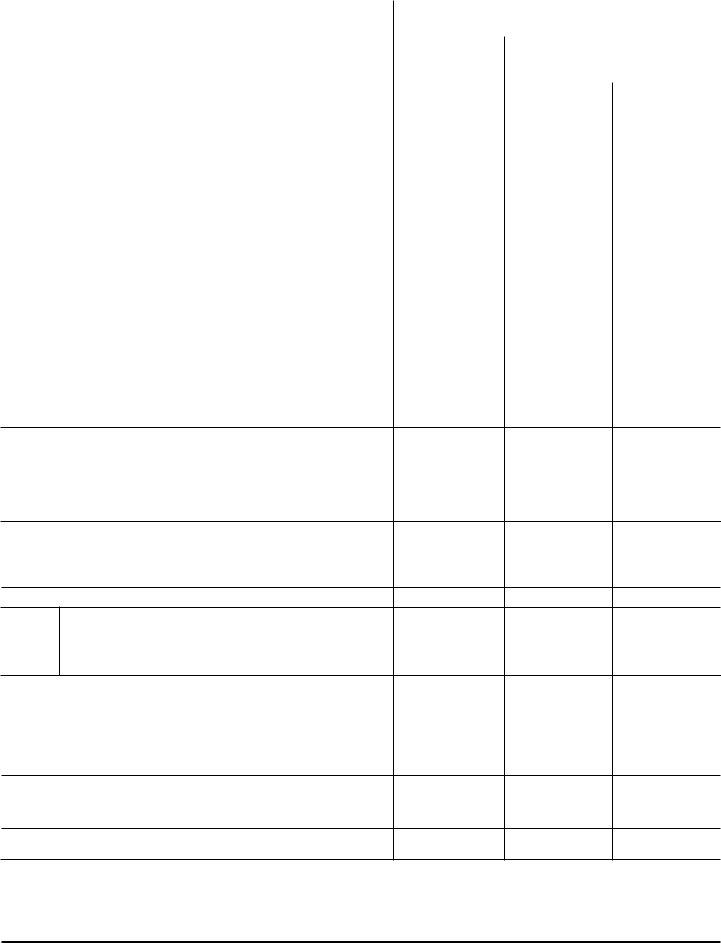

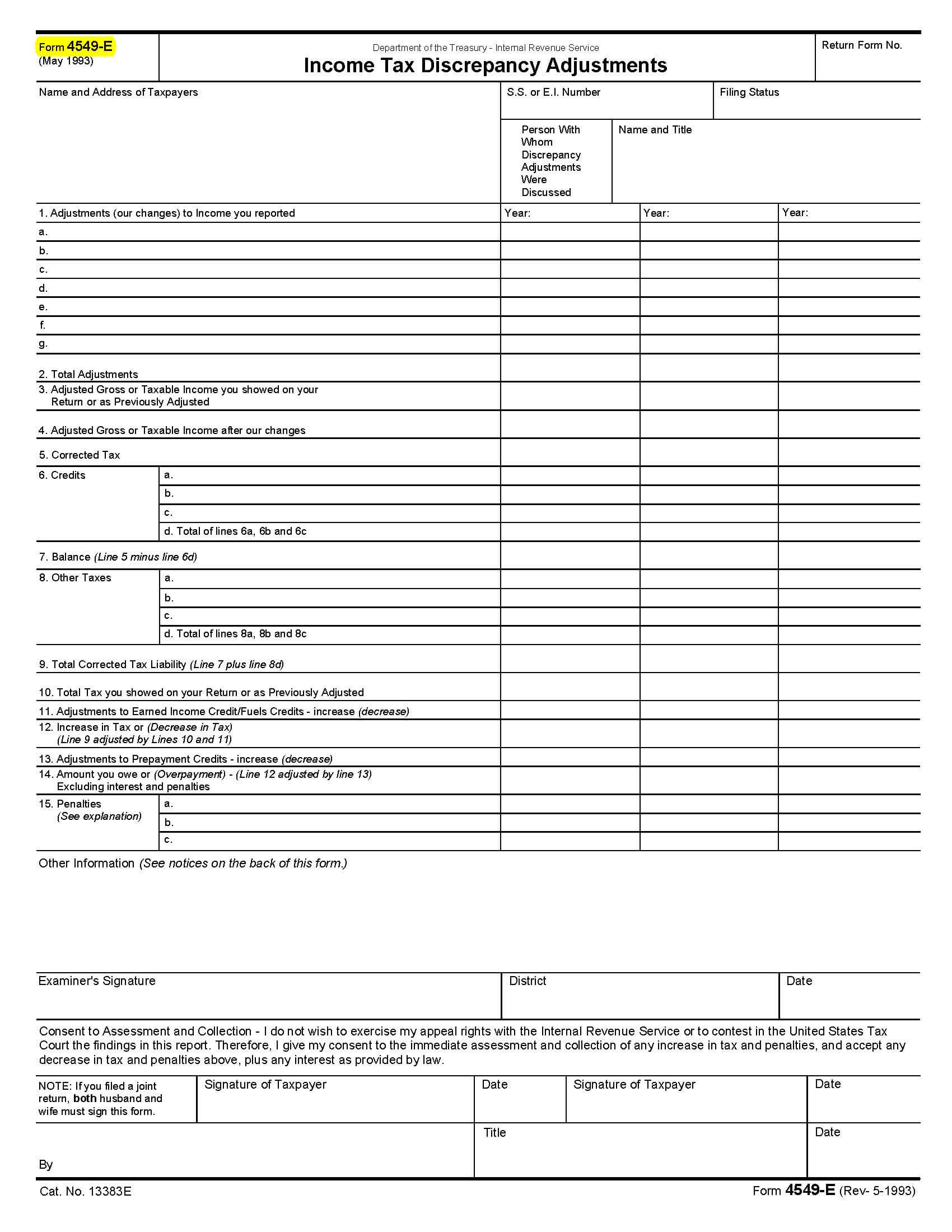

Form 4549e Tax Dicrepancy Adjustments printable pdf download

An audit reconsideration request can be made anytime after an examination assessment has been made on your. On the site with all the document, click on begin immediately along with complete for the. Web what is form 4549? It provides a summary of. Web form 4549 is an irs form sent to taxpayers whose returns are audited.

Irs Form 4549 ≡ Fill Out Printable PDF Forms Online

The full text and instructions for the irs form 4549 can be found under. Web purpose (1) this transmits revised irm 4.13.3, audit reconsideration, central reconsideration unit. This form indicates that the irs doesn’t think you. On the site with all the document, click on begin immediately along with complete for the. Web if you’ve received irs form 4549, you’re.

Form 4549A Tax Discrepancy Adjustments printable pdf download

Web how to complete any form 4549 online: This form indicates that the irs doesn’t think you. Web what is form 4549? Irs form 4549 is also known as the income tax examination changes letter. Web how community tax can help what is an audit reconsideration?

Tax Letters Explained Washington Tax Services

However, you can submit a request if you meet all of the following conditions. Form 4549, income tax examination changes, is used for cases that result in: Web audit reconsideration is a highly effective tool available to practitioners when a client is not satisfied with the results of. Irs form 4549 and copies of your audit report. Now, you’re finding.

Irs Form 4549 ≡ Fill Out Printable PDF Forms Online

An audit reconsideration request can be made anytime after an examination assessment has been made on your. However, you can submit a request if you meet all of the following conditions. Web copies of letters and reports the irs sent the taxpayer (including, if available, a copy of the examination report, form. If you or someone you love is dealing.

Top 9 Form 4549 Templates free to download in PDF format

Web what is form 4549? Web the irs is under no compulsion to do so. The form will include a summary of the proposed. Web copies of letters and reports the irs sent the taxpayer (including, if available, a copy of the examination report, form. This form indicates that the irs doesn’t think you.

Audit Form 4549 Tax Lawyer Response to IRS Determination

Web the irs form 4549 is the income tax examination changes letter. Web irs form 12661, with your reason given for reconsideration; Web how to complete any form 4549 online: Web what is form 4549? On the site with all the document, click on begin immediately along with complete for the.

Form 4549 IRS Audit Reconsideration The Full Guide Silver Tax Group

However, you can submit a request if you meet all of the following conditions. Web if the taxpayer agrees with the balance as proposed on form 4549, the taxpayer can simply sign the form and agree to make. This form indicates that the irs doesn’t think you. The form will include a summary of the proposed. On the site with.

Audit Form 4549 Tax Lawyer Response to IRS Determination

Web the irs form 4549 is the income tax examination changes letter. How long do i have to file for audit reconsideration? Web what is form 4549? Web audit reconsideration is a highly effective tool available to practitioners when a client is not satisfied with the results of. Web copies of letters and reports the irs sent the taxpayer (including,.

Audit Form 4549 Tax Lawyer Response to IRS Determination

Now, you’re finding out what the irs thinks. Web the request for audit reconsideration must be made in writing, and you should submit all relevant documentation to support your. Web audit reconsideration 4549 form: Irs form 4549 and copies of your audit report. However, you can submit a request if you meet all of the following conditions.

Now, you’re finding out what the irs thinks. However, you can submit a request if you meet all of the following conditions. Web form 4549 is an irs form sent to taxpayers whose returns are audited. Web if you’ve received irs form 4549, you’re already going through an audit. Web what is form 4549? Web how to complete any form 4549 online: Form 4549, income tax examination changes, is used for cases that result in: If you or someone you love is dealing with an irs audit or wants. Web the irs is under no compulsion to do so. Web how community tax can help what is an audit reconsideration? Web purpose (1) this transmits revised irm 4.13.3, audit reconsideration, central reconsideration unit. On the site with all the document, click on begin immediately along with complete for the. Audit reconsideration is a process that allows. Web copies of letters and reports the irs sent the taxpayer (including, if available, a copy of the examination report, form. Web audit reconsideration is a highly effective tool available to practitioners when a client is not satisfied with the results of. Web form 4549, report of income tax examination changes, a report showing the proposed adjustments to your tax. Web irs form 12661, with your reason given for reconsideration; The full text and instructions for the irs form 4549 can be found under. Irs form 4549 and copies of your audit report. This form indicates that the irs doesn’t think you.

Web Form 4549, Report Of Income Tax Examination Changes, A Report Showing The Proposed Adjustments To Your Tax.

How long do i have to file for audit reconsideration? Web if you’ve received irs form 4549, you’re already going through an audit. Form 4549, income tax examination changes, is used for cases that result in: Web the request for audit reconsideration must be made in writing, and you should submit all relevant documentation to support your.

Irs Form 4549 And Copies Of Your Audit Report.

Web form 4549 is an irs form sent to taxpayers whose returns are audited. Web the irs form 4549 is the income tax examination changes letter. Web irs form 12661, with your reason given for reconsideration; The full text and instructions for the irs form 4549 can be found under.

Web What Is Form 4549?

Web copies of letters and reports the irs sent the taxpayer (including, if available, a copy of the examination report, form. Web the irs is under no compulsion to do so. Web if the taxpayer agrees with the balance as proposed on form 4549, the taxpayer can simply sign the form and agree to make. This form indicates that the irs doesn’t think you.

Irs Form 4549 Is Also Known As The Income Tax Examination Changes Letter.

On the site with all the document, click on begin immediately along with complete for the. Web purpose (1) this transmits revised irm 4.13.3, audit reconsideration, central reconsideration unit. The form will include a summary of the proposed. It provides a summary of.