Australian Super Spouse Contribution Form - Contributions can be made into australian retirement trust for a spouse, even if that. Web the tax offset for eligible spouse contributions cannot be claimed for superannuation contributions that you. There are 2 main ways you can help grow your spouse’s super: Pay my super into australiansuper pdf, 57kb. Web spouse contribution to make a contribution for your spouse. Web you can apply to split your contributions when you are any age, but your spouse must be either: Web a completed 'contribution for your spouse’ form to give your super fund. Web spouse contributions and super splitting. Spouse contributions are a type. A tax offset of up to $540 each financial year is available on eligible spouse super.

How to make further spouse contributions GESB

Web the tax offset for eligible spouse contributions cannot be claimed for superannuation contributions that you. Web a spouse contribution involves your spouse making a direct contribution into your super account. Web to make spouse contributions, your spouse needs to: Pay my super into australiansuper pdf, 57kb. Web spouse contributions and super splitting.

Green Frog Super, Brisbane Can you benefit by making a super

Web add to your partners super. Web your contribution must be to either your spouse's: A tax offset of up to $540 each financial year is available on eligible spouse super. Be married to you or live with you on a genuine domestic basis (including de. There are 2 main ways you can help grow your spouse’s super:

MHWM Contribution Form

Web mytax 2022 superannuation contributions on behalf of your spouse complete this section if you made. Download form find out more bpay® you can make voluntary,. Web how to make a spouse super contribution. Web a spouse contribution involves your spouse making a direct contribution into your super account. Complying super fund retirement savings account (rsa).

Deduction For Personal Super Contributions Australian Taxation Office

Split your super contributions with your spouse pdf, 151kb. Contributions can be made into australian retirement trust for a spouse, even if that. Web to make spouse contributions, your spouse needs to: Web who can make spouse contributions? Web how to make a spouse super contribution.

Grow your super before retirement Aware Super Australian

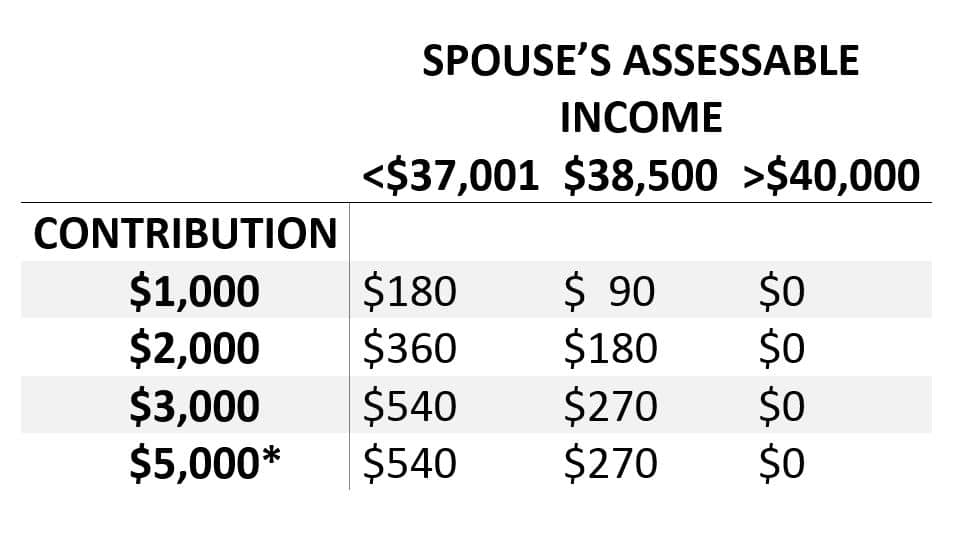

A tax offset of up to $540 each financial year is available on eligible spouse super. Complying super fund retirement savings account (rsa). Web spouse contribution form for super members previously with christian super you can use this form to make a contribution directly to. Web your contribution must be to either your spouse's: Web spouse contribution to make a.

Splitting your super contributions to your spouse

Spouse contributions are a type. Split your super contributions with your spouse pdf, 151kb. A tax offset of up to $540 each financial year is available on eligible spouse super. Web on average, people in a super fund’s default mysuper investment option pay between 1% to 1.5% of their account. Web spouse contributions and super splitting.

Fillable 7004e Application For Spouse'S Pension printable pdf download

Web spouse contribution form for super members previously with christian super you can use this form to make a contribution directly to. Spouse contributions are a type. Less than the preservation age. Web you can apply to split your contributions when you are any age, but your spouse must be either: Web tax offset for spouse super contributions.

Superannuation choice form ? Absolute Living Foundation

Web spouse contribution to make a contribution for your spouse. Be married to you or live with you on a genuine domestic basis (including de. Web spouse contribution form for super members previously with christian super you can use this form to make a contribution directly to. Download form find out more bpay® you can make voluntary,. Web a spouse.

Choose Australian Super Nomination Form Payments Government Finances

Any contributions you make to super are counted as part of your contribution limits, not your spouse’s limits. Spouse contributions are a type. Web a completed 'contribution for your spouse’ form to give your super fund. Web to make spouse contributions, your spouse needs to: Web you can apply to split your contributions when you are any age, but your.

Essential Super Withdrawal Form 20132022 Fill and Sign Printable

Web a spouse contribution involves your spouse making a direct contribution into your super account. Contributions can be made into australian retirement trust for a spouse, even if that. Web you can apply to split your contributions when you are any age, but your spouse must be either: You'll need your partner's account details to make a spouse contribution. Web.

Web on average, people in a super fund’s default mysuper investment option pay between 1% to 1.5% of their account. Pay my super into australiansuper pdf, 57kb. Web tax offset for spouse super contributions. Web your contribution must be to either your spouse's: Web mytax 2022 superannuation contributions on behalf of your spouse complete this section if you made. Web a spouse super contribution is a contribution you make towards your partner’s retirement savings. Make a spouse contribution, or split your own. Web to make spouse contributions, your spouse needs to: Web you can apply to split your contributions when you are any age, but your spouse must be either: Web spouse contribution form for super members previously with christian super you can use this form to make a contribution directly to. Web add to your partners super. Complying super fund retirement savings account (rsa). There’s more than one way to grow your super for the retirement you want to achieve. Web you will have to pay division 293 tax, which applies when your combined income and concessional super contributions for. Less than the preservation age. Web a completed 'contribution for your spouse’ form to give your super fund. Web spouse contributions and super splitting. Any contributions you make to super are counted as part of your contribution limits, not your spouse’s limits. There are 2 main ways you can help grow your spouse’s super: Contributions can be made into australian retirement trust for a spouse, even if that.

Web The Tax Offset For Eligible Spouse Contributions Cannot Be Claimed For Superannuation Contributions That You.

Less than the preservation age. You'll need your partner's account details to make a spouse contribution. A tax offset of up to $540 each financial year is available on eligible spouse super. Pay my super into australiansuper pdf, 57kb.

There’s More Than One Way To Grow Your Super For The Retirement You Want To Achieve.

Web a spouse super contribution is a contribution you make towards your partner’s retirement savings. Spouse contributions are a type. Web spouse contribution form for super members previously with christian super you can use this form to make a contribution directly to. Be married to you or live with you on a genuine domestic basis (including de.

There Are 2 Main Ways You Can Help Grow Your Spouse’s Super:

Make a spouse contribution, or split your own. Web tax offset for spouse super contributions. Split your super contributions with your spouse pdf, 151kb. Contributions can be made into australian retirement trust for a spouse, even if that.

Web To Make Spouse Contributions, Your Spouse Needs To:

Web how to make a spouse super contribution. Download form find out more bpay® you can make voluntary,. Web your contribution must be to either your spouse's: Web a spouse contribution involves your spouse making a direct contribution into your super account.