Colorado Form 104Pn - Use this form if you and/or your spouse were a resident of. Web tax is prorated so that it is calculated only on income received in colorado or from sources within colorado. Web form 104pn requires you to list multiple forms of income, such as wages, interest, or alimony. We recommend you review income tax topics:

Colorado Tax Table Form 104pn

Web tax is prorated so that it is calculated only on income received in colorado or from sources within colorado. Web form 104pn requires you to list multiple forms of income, such as wages, interest, or alimony. We recommend you review income tax topics: Use this form if you and/or your spouse were a resident of.

Printable Colorado Tax Form 104 Printable Forms Free Online

Web tax is prorated so that it is calculated only on income received in colorado or from sources within colorado. We recommend you review income tax topics: Use this form if you and/or your spouse were a resident of. Web form 104pn requires you to list multiple forms of income, such as wages, interest, or alimony.

Form 104pn PartYear Resident/nonresident Tax Calculation Schedule

Use this form if you and/or your spouse were a resident of. Web form 104pn requires you to list multiple forms of income, such as wages, interest, or alimony. We recommend you review income tax topics: Web tax is prorated so that it is calculated only on income received in colorado or from sources within colorado.

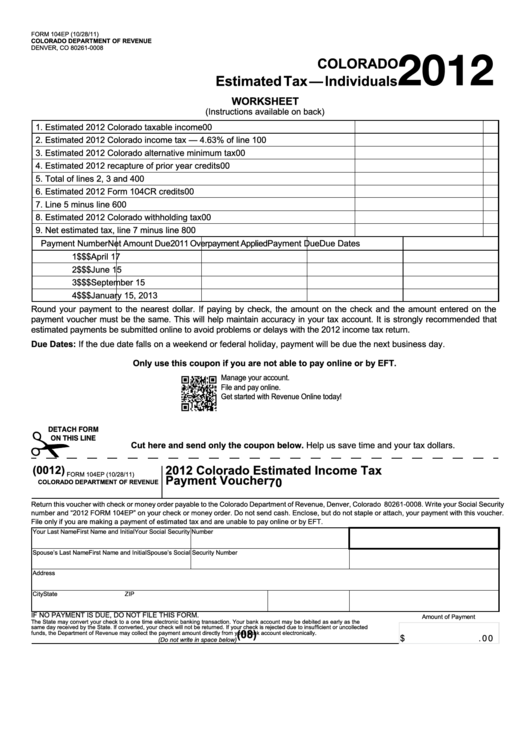

Form 104ep Colorado TaxIndividuals Worksheet 2012 printable pdf

Web form 104pn requires you to list multiple forms of income, such as wages, interest, or alimony. Web tax is prorated so that it is calculated only on income received in colorado or from sources within colorado. We recommend you review income tax topics: Use this form if you and/or your spouse were a resident of.

2020 Form CO DoR 104PN Fill Online, Printable, Fillable, Blank pdfFiller

Web form 104pn requires you to list multiple forms of income, such as wages, interest, or alimony. We recommend you review income tax topics: Use this form if you and/or your spouse were a resident of. Web tax is prorated so that it is calculated only on income received in colorado or from sources within colorado.

Fill Free fillable Form 104PN PartYear Resident/Nonresident Tax

We recommend you review income tax topics: Web tax is prorated so that it is calculated only on income received in colorado or from sources within colorado. Web form 104pn requires you to list multiple forms of income, such as wages, interest, or alimony. Use this form if you and/or your spouse were a resident of.

TaxHow » Colorado Tax Forms 2017

We recommend you review income tax topics: Web tax is prorated so that it is calculated only on income received in colorado or from sources within colorado. Use this form if you and/or your spouse were a resident of. Web form 104pn requires you to list multiple forms of income, such as wages, interest, or alimony.

2013 colorado 104pn form Fill out & sign online DocHub

Web form 104pn requires you to list multiple forms of income, such as wages, interest, or alimony. Web tax is prorated so that it is calculated only on income received in colorado or from sources within colorado. Use this form if you and/or your spouse were a resident of. We recommend you review income tax topics:

Fillable Form 104 Colorado Individual Tax 2013 printable pdf

We recommend you review income tax topics: Use this form if you and/or your spouse were a resident of. Web form 104pn requires you to list multiple forms of income, such as wages, interest, or alimony. Web tax is prorated so that it is calculated only on income received in colorado or from sources within colorado.

Colorado Form 104Pn ≡ Fill Out Printable PDF Forms Online

Web form 104pn requires you to list multiple forms of income, such as wages, interest, or alimony. Use this form if you and/or your spouse were a resident of. We recommend you review income tax topics: Web tax is prorated so that it is calculated only on income received in colorado or from sources within colorado.

Web form 104pn requires you to list multiple forms of income, such as wages, interest, or alimony. Use this form if you and/or your spouse were a resident of. We recommend you review income tax topics: Web tax is prorated so that it is calculated only on income received in colorado or from sources within colorado.

Web Tax Is Prorated So That It Is Calculated Only On Income Received In Colorado Or From Sources Within Colorado.

We recommend you review income tax topics: Web form 104pn requires you to list multiple forms of income, such as wages, interest, or alimony. Use this form if you and/or your spouse were a resident of.