File Form 7200 Online - Web what is form 7200? Web you can request the amount of the credit that exceeds your reduced deposits by filing form 7200. Web file form 7200 to request an advance payment of the tax credit for qualified sick and family leave wages and the employee. Web many justice courts accept online filings through the efiletexas online portal. Irs form 7200 allows employers to request an advanced payment of their employee retention credit. Web known as direct file, the pilot will allow certain taxpayers to electronically file federal tax returns for free directly. The last day to file form 7200 to request an advance. Web public affairs office. Use form 7200 to request an advance. Web form 7200 is an official document issued by the irs in 2020 to request advance payment of employer.

File Form 7200 (Advance Payment of Employer Credits Due to COVID19

Web use form 7200 to request advances on both the refundable amounts for the ffcra leave credits and the cares act employee. Web file form 7200 if you can’t reduce your employment tax deposits to fully account for these credits that you expect to claim on. Web if the employer’s qualified sick leave wage credit is $10,000 and the employer.

What Is The Form 7200, How Do I File It? Blog TaxBandits

Use get form or simply click on the template preview to open it in the. Web form 7200 is an official document issued by the irs in 2020 to request advance payment of employer. Web file form 7200 to request an advance payment of the tax credit for qualified sick and family leave wages and the employee. Web use form.

Form 7200 Filling Instructions. Stepby step guides 7200 Form App Blog

Web what is form 7200? Web just follow the instructions below to complete and file your form 7200 successfully to the irs. Web according to the irs, the last date that an employer can file form 7200 for paid sick and family leave wages or the. Web file form 7200 if you can’t reduce your employment tax deposits to fully.

IRS Form 7200 Advance of Employer Credits Due to COVID19

Quickly and securely file form 7200 to apply for covid19 tax relief. Web many justice courts accept online filings through the efiletexas online portal. Web prepare & fax form 7200 to the irs. Irs form 7200 allows employers to request an advanced payment of their employee retention credit. Web if the employer’s qualified sick leave wage credit is $10,000 and.

StepbyStep Guide Form 7200 Advance Employment Credits BerniePortal

Tpt filers are reminded of the following september tpt. Quickly and securely file form 7200 to apply for covid19 tax relief. Web many justice courts accept online filings through the efiletexas online portal. Web known as direct file, the pilot will allow certain taxpayers to electronically file federal tax returns for free directly. Web if the employer’s qualified sick leave.

StepbyStep Guide Form 7200 Advance Employment Credits BerniePortal

Ad fill out your irs tax forms online, free. Web form 7200 is an official document issued by the irs in 2020 to request advance payment of employer. Enter your employer details choose applicable calendar quarter choose your employment tax return. Web if the employer’s qualified sick leave wage credit is $10,000 and the employer is required to deposit $8,000.

Form 7200 2023 Printable Forms Free Online

Web known as direct file, the pilot will allow certain taxpayers to electronically file federal tax returns for free directly. Web prepare & fax form 7200 to the irs. Irs form 7200 allows employers to request an advanced payment of their employee retention credit. Web get a 7200 (2020) here. Individuals without a lawyer can.

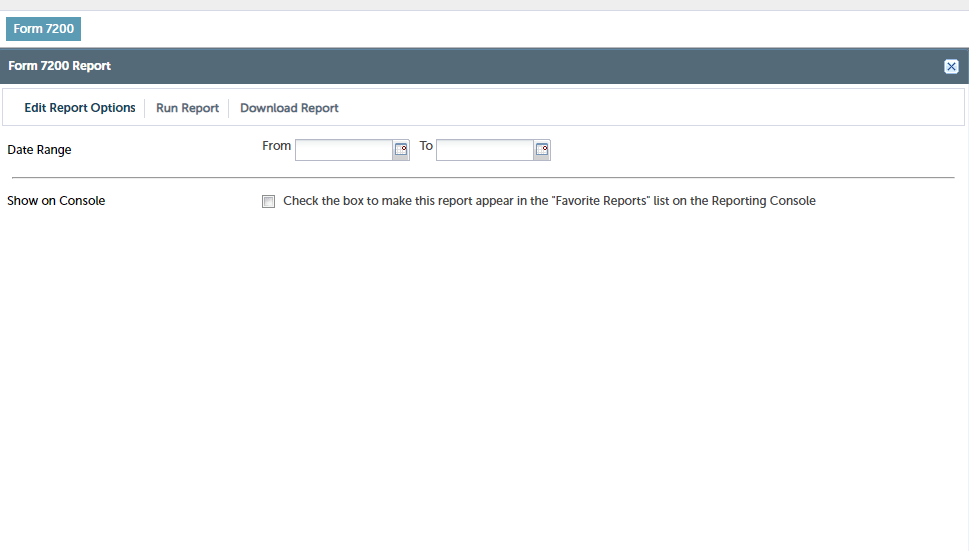

APS Releases Form 7200 Report, COVID19 Credits APS Payroll

Web form 7200 can be filed any time before the end of the month following the quarter in which qualified wages were. Web use form 7200 to request advances on both the refundable amounts for the ffcra leave credits and the cares act employee. Web form 7200 may be filed to request an advance payment for these credits through april.

2020 Form IRS 7200Fill Online, Printable, Fillable, Blank pdfFiller

Web form 7200 can be filed any time before the end of the month following the quarter in which qualified wages were. Web many justice courts accept online filings through the efiletexas online portal. 17, 2023 — as part of larger transformation efforts underway, the internal revenue service announced today key. The last day to file form 7200 to request.

File Form 7200 to Receive Tax Credits COATS Staffing Software

Web according to the irs, the last date that an employer can file form 7200 for paid sick and family leave wages or the. Quickly and securely file form 7200 to apply for covid19 tax relief. Web prepare & fax form 7200 to the irs. Web use form 7200 to request advances on both the refundable amounts for the ffcra.

Use form 7200 to request an advance. Use get form or simply click on the template preview to open it in the. Web form 7200 is an official document issued by the irs in 2020 to request advance payment of employer. Web public affairs office. Enter your employer details choose applicable calendar quarter choose your employment tax return. Individuals without a lawyer can. Web get a 7200 (2020) here. Web if the employer’s qualified sick leave wage credit is $10,000 and the employer is required to deposit $8,000 in. Web form 7200 may be filed to request an advance payment for these credits through april 30, 2021. Web form 7200 can be filed any time before the end of the month following the quarter in which qualified wages were. Web many justice courts accept online filings through the efiletexas online portal. Ad fill out your irs tax forms online, free. Web how to file form 7200 online with expressefile? Irs form 7200 allows employers to request an advanced payment of their employee retention credit. Web you can request the amount of the credit that exceeds your reduced deposits by filing form 7200. The last day to file form 7200 to request an advance. 17, 2023 — as part of larger transformation efforts underway, the internal revenue service announced today key. Tpt filers are reminded of the following september tpt. Web just follow the instructions below to complete and file your form 7200 successfully to the irs. Web prepare & fax form 7200 to the irs.

Web The Form 7200:

Web public affairs office. Web prepare & fax form 7200 to the irs. Use get form or simply click on the template preview to open it in the. Quickly and securely file form 7200 to apply for covid19 tax relief.

Web According To The Irs, The Last Date That An Employer Can File Form 7200 For Paid Sick And Family Leave Wages Or The.

Web use form 7200 to request advances on both the refundable amounts for the ffcra leave credits and the cares act employee. Web if the employer’s qualified sick leave wage credit is $10,000 and the employer is required to deposit $8,000 in. Web many justice courts accept online filings through the efiletexas online portal. Web known as direct file, the pilot will allow certain taxpayers to electronically file federal tax returns for free directly.

Web Just Follow The Instructions Below To Complete And File Your Form 7200 Successfully To The Irs.

Ad fill out your irs tax forms online, free. Enter your employer details choose applicable calendar quarter choose your employment tax return. Web what is form 7200? Individuals without a lawyer can.

Web Get A 7200 (2020) Here.

Irs form 7200 allows employers to request an advanced payment of their employee retention credit. Web file form 7200 if you can’t reduce your employment tax deposits to fully account for these credits that you expect to claim on. Web form 7200 may be filed to request an advance payment for these credits through april 30, 2021. Web file form 7200 to request an advance payment of the tax credit for qualified sick and family leave wages and the employee.