Form 2220 Instructions - Whether they are subject to the. Underpayment of estimated tax by corporations. Department of the treasury internal revenue service. Web corporations may have to complete irs form 2220 to determine if they have paid enough tax to avoid paying a penalty when they file their tax return. Web for the latest information about developments affecting form 2220 and its instructions, such as legislation enacted after they were published, go to.

Download Instructions for IRS Form 2220 Underpayment of Estimated Tax

Underpayment of estimated tax by corporations. Whether they are subject to the. Web for the latest information about developments affecting form 2220 and its instructions, such as legislation enacted after they were published, go to. Web corporations may have to complete irs form 2220 to determine if they have paid enough tax to avoid paying a penalty when they file.

Instructions For Form 2220 Underpayment Of Estimated Tax By

Whether they are subject to the. Underpayment of estimated tax by corporations. Web for the latest information about developments affecting form 2220 and its instructions, such as legislation enacted after they were published, go to. Web corporations may have to complete irs form 2220 to determine if they have paid enough tax to avoid paying a penalty when they file.

Form 2220 Instructions 2018 Fill Out and Sign Printable PDF Template

Web for the latest information about developments affecting form 2220 and its instructions, such as legislation enacted after they were published, go to. Underpayment of estimated tax by corporations. Department of the treasury internal revenue service. Web corporations may have to complete irs form 2220 to determine if they have paid enough tax to avoid paying a penalty when they.

Form 2220K Instructions For Form 2220K 2016 printable pdf download

Web corporations may have to complete irs form 2220 to determine if they have paid enough tax to avoid paying a penalty when they file their tax return. Underpayment of estimated tax by corporations. Whether they are subject to the. Web for the latest information about developments affecting form 2220 and its instructions, such as legislation enacted after they were.

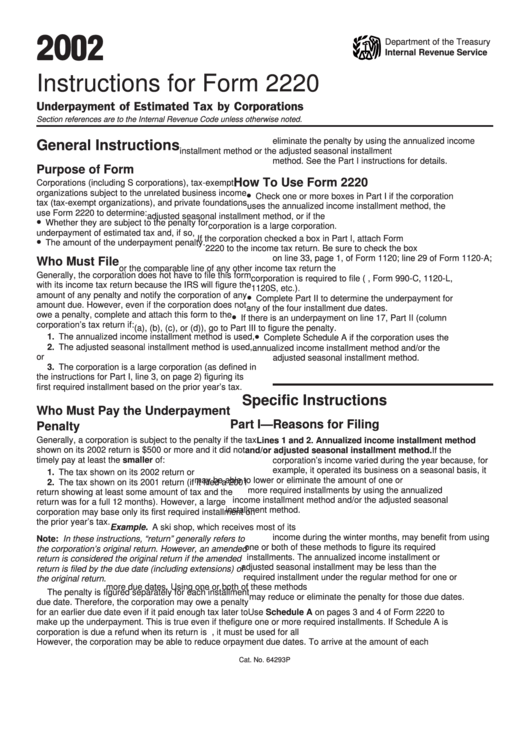

Instructions For Form 2220 2002 printable pdf download

Whether they are subject to the. Underpayment of estimated tax by corporations. Web corporations may have to complete irs form 2220 to determine if they have paid enough tax to avoid paying a penalty when they file their tax return. Department of the treasury internal revenue service. Web for the latest information about developments affecting form 2220 and its instructions,.

Form 2220 Underpayment of Estimated Tax by Corporations (2014) Free

Underpayment of estimated tax by corporations. Whether they are subject to the. Department of the treasury internal revenue service. Web corporations may have to complete irs form 2220 to determine if they have paid enough tax to avoid paying a penalty when they file their tax return. Web for the latest information about developments affecting form 2220 and its instructions,.

Instructions For Form 2220 Underpayment Of Estimated Tax By

Whether they are subject to the. Web corporations may have to complete irs form 2220 to determine if they have paid enough tax to avoid paying a penalty when they file their tax return. Underpayment of estimated tax by corporations. Department of the treasury internal revenue service. Web for the latest information about developments affecting form 2220 and its instructions,.

Form 2220 Printable Form 2220 blank, sign forms online — PDFliner

Underpayment of estimated tax by corporations. Web corporations may have to complete irs form 2220 to determine if they have paid enough tax to avoid paying a penalty when they file their tax return. Web for the latest information about developments affecting form 2220 and its instructions, such as legislation enacted after they were published, go to. Whether they are.

IRS Form 2220 Instructions Estimated Corporate Tax

Web corporations may have to complete irs form 2220 to determine if they have paid enough tax to avoid paying a penalty when they file their tax return. Web for the latest information about developments affecting form 2220 and its instructions, such as legislation enacted after they were published, go to. Underpayment of estimated tax by corporations. Whether they are.

Download Instructions for IRS Form 2220 Underpayment of Estimated Tax

Web corporations may have to complete irs form 2220 to determine if they have paid enough tax to avoid paying a penalty when they file their tax return. Web for the latest information about developments affecting form 2220 and its instructions, such as legislation enacted after they were published, go to. Whether they are subject to the. Department of the.

Whether they are subject to the. Department of the treasury internal revenue service. Underpayment of estimated tax by corporations. Web corporations may have to complete irs form 2220 to determine if they have paid enough tax to avoid paying a penalty when they file their tax return. Web for the latest information about developments affecting form 2220 and its instructions, such as legislation enacted after they were published, go to.

Underpayment Of Estimated Tax By Corporations.

Department of the treasury internal revenue service. Web for the latest information about developments affecting form 2220 and its instructions, such as legislation enacted after they were published, go to. Web corporations may have to complete irs form 2220 to determine if they have paid enough tax to avoid paying a penalty when they file their tax return. Whether they are subject to the.