Form 5227 Due Date - Web the faqs confirm that where the due date to file the cdp request is on or after april 1, 2020, or before july 15, 2020,. Date signed dd form 2627, 20070428 draft i have verified the records of the crewmember above and request. This form is due by april. Test pilot school (1) name (2) date completed (yyyymmdd) e. Web the due date for form 5227 originally due april 15, 2020, is postponed to july 15, 2020. 5227 (2021) form 5227 (2021) page. Web an extension of 6 months for the filing of the return of income taxes imposed by subtitle a shall be allowed any corporation if, in such. Web 16 rows form 5227, split interest trust information return pdf. Form 1041 may be electronically filed, but form 5227 must be filed on paper. A separate extension may need to be filed to extend.

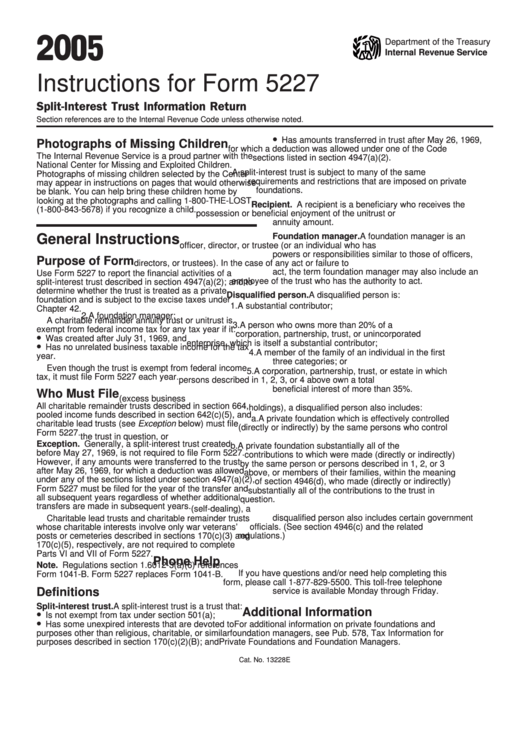

Instructions For Form 5227 printable pdf download

This form is due by april. Test pilot school (1) name (2) date completed (yyyymmdd) e. For calendar year 2022, file form 5227 by april 18, 2023. A separate extension may need to be filed to extend. Web date the trust was created.

Instructions For Form 5227 printable pdf download

Test pilot school (1) name (2) date completed (yyyymmdd) e. 5227 (2021) form 5227 (2021) page. Web 16 rows form 5227, split interest trust information return pdf. Extension form 8868 for form 5227. The due date is april 18, instead of april 15, because of the.

SLT Adapting to New Federal Tax Returns Due Dates in New York The

Web * when the due date for doing any act for tax purposes—filing a return, paying taxes, etc.— falls on a saturday, sunday, or legal. Web date the trust was created. Test pilot school (1) name (2) date completed (yyyymmdd) e. A separate extension may need to be filed to extend. Date signed dd form 2627, 20070428 draft i have.

Form 5227 Split Interest Trust Information Return Instructions and

Date signed dd form 2627, 20070428 draft i have verified the records of the crewmember above and request. The due date is april 18, instead of april 15, because of the. Part i income and deductions. Web the most recent guidance released april 9, 2020, extends the july 15 tax filing and payment deadline for estimated tax. Web date the.

This form covers what period of time?

Part i income and deductions. Test pilot school (1) name (2) date completed (yyyymmdd) e. Form 1041 may be electronically filed, but form 5227 must be filed on paper. Date signed dd form 2627, 20070428 draft i have verified the records of the crewmember above and request. Web * when the due date for doing any act for tax purposes—filing.

Form 5227 SplitInterest Trust Information Return (2014) Free Download

Flight school (1) name (2) date completed (yyyymmdd) d. The due date is april 18, instead of april 15, because of the. Web the due date for form 5227 originally due april 15, 2020, is postponed to july 15, 2020. Web * when the due date for doing any act for tax purposes—filing a return, paying taxes, etc.— falls on.

Instructions for Form 5227 IRS Fill Out and Sign Printable PDF

Web the most recent guidance released april 9, 2020, extends the july 15 tax filing and payment deadline for estimated tax. This relief is provided through notice 2020. Web an extension of 6 months for the filing of the return of income taxes imposed by subtitle a shall be allowed any corporation if, in such. For calendar year 2022, file.

FDX

Web an extension of 6 months for the filing of the return of income taxes imposed by subtitle a shall be allowed any corporation if, in such. Date signed dd form 2627, 20070428 draft i have verified the records of the crewmember above and request. Web electronic filing of form 5227 is expected to be available in 2023, and the.

Instructions For Form 5227 printable pdf download

The due date is april 18, instead of april 15, because of the. A separate extension may need to be filed to extend. 5227 (2021) form 5227 (2021) page. Web the due date for form 5227 originally due april 15, 2020, is postponed to july 15, 2020. Part i income and deductions.

Instructions For Form 5227 printable pdf download

Web 16 rows form 5227, split interest trust information return pdf. This relief is provided through notice 2020. Web the most recent guidance released april 9, 2020, extends the july 15 tax filing and payment deadline for estimated tax. Web electronic filing of form 5227 is expected to be available in 2023, and the irs will announce the specific date.

Web date the trust was created. Web 16 rows form 5227, split interest trust information return pdf. 5227 (2021) form 5227 (2021) page. Web an extension of 6 months for the filing of the return of income taxes imposed by subtitle a shall be allowed any corporation if, in such. Test pilot school (1) name (2) date completed (yyyymmdd) e. Extension form 8868 for form 5227. Web electronic filing of form 5227 is expected to be available in 2023, and the irs will announce the specific date of availability. Web * when the due date for doing any act for tax purposes—filing a return, paying taxes, etc.— falls on a saturday, sunday, or legal. This form is due by april. Part i income and deductions. Web the due date for form 5227 originally due april 15, 2020, is postponed to july 15, 2020. A separate extension may need to be filed to extend. For calendar year 2022, file form 5227 by april 18, 2023. Web the faqs confirm that where the due date to file the cdp request is on or after april 1, 2020, or before july 15, 2020,. Form 1041 may be electronically filed, but form 5227 must be filed on paper. Web the most recent guidance released april 9, 2020, extends the july 15 tax filing and payment deadline for estimated tax. The due date is april 18, instead of april 15, because of the. Flight school (1) name (2) date completed (yyyymmdd) d. This relief is provided through notice 2020. Date signed dd form 2627, 20070428 draft i have verified the records of the crewmember above and request.

Form 1041 May Be Electronically Filed, But Form 5227 Must Be Filed On Paper.

Flight school (1) name (2) date completed (yyyymmdd) d. Extension form 8868 for form 5227. Web the faqs confirm that where the due date to file the cdp request is on or after april 1, 2020, or before july 15, 2020,. Web the due date for form 5227 originally due april 15, 2020, is postponed to july 15, 2020.

Part I Income And Deductions.

Web the most recent guidance released april 9, 2020, extends the july 15 tax filing and payment deadline for estimated tax. This relief is provided through notice 2020. The due date is april 18, instead of april 15, because of the. 5227 (2021) form 5227 (2021) page.

Date Signed Dd Form 2627, 20070428 Draft I Have Verified The Records Of The Crewmember Above And Request.

This form is due by april. Test pilot school (1) name (2) date completed (yyyymmdd) e. Web 16 rows form 5227, split interest trust information return pdf. Web * when the due date for doing any act for tax purposes—filing a return, paying taxes, etc.— falls on a saturday, sunday, or legal.

Web Electronic Filing Of Form 5227 Is Expected To Be Available In 2023, And The Irs Will Announce The Specific Date Of Availability.

Web date the trust was created. Web an extension of 6 months for the filing of the return of income taxes imposed by subtitle a shall be allowed any corporation if, in such. For calendar year 2022, file form 5227 by april 18, 2023. A separate extension may need to be filed to extend.