Form 8996 Instructions - Web use form 8997 to inform the irs of the qof investments and deferred gains held at the beginning and end of the current tax year, as well as any capital. Web for paperwork reduction act notice, see your tax return instructions. Web you must file form 8996 by the due date of the tax return (including extensions).

1095 C Form Instructions Form Resume Examples Oa6YnNYBgP

Web you must file form 8996 by the due date of the tax return (including extensions). Web use form 8997 to inform the irs of the qof investments and deferred gains held at the beginning and end of the current tax year, as well as any capital. Web for paperwork reduction act notice, see your tax return instructions.

Download Instructions for IRS Form 8996 Qualified Opportunity Fund PDF

Web you must file form 8996 by the due date of the tax return (including extensions). Web for paperwork reduction act notice, see your tax return instructions. Web use form 8997 to inform the irs of the qof investments and deferred gains held at the beginning and end of the current tax year, as well as any capital.

Form 15g Sample Filled Form Printable Forms Free Online

Web use form 8997 to inform the irs of the qof investments and deferred gains held at the beginning and end of the current tax year, as well as any capital. Web for paperwork reduction act notice, see your tax return instructions. Web you must file form 8996 by the due date of the tax return (including extensions).

IRS Form 8996 Qualified Opportunity Fund Lies on Flat Lay Office Table

Web you must file form 8996 by the due date of the tax return (including extensions). Web for paperwork reduction act notice, see your tax return instructions. Web use form 8997 to inform the irs of the qof investments and deferred gains held at the beginning and end of the current tax year, as well as any capital.

Download Instructions for IRS Form 8996 Qualified Opportunity Fund PDF

Web use form 8997 to inform the irs of the qof investments and deferred gains held at the beginning and end of the current tax year, as well as any capital. Web you must file form 8996 by the due date of the tax return (including extensions). Web for paperwork reduction act notice, see your tax return instructions.

Download Instructions for IRS Form 8996 Qualified Opportunity Fund PDF

Web use form 8997 to inform the irs of the qof investments and deferred gains held at the beginning and end of the current tax year, as well as any capital. Web you must file form 8996 by the due date of the tax return (including extensions). Web for paperwork reduction act notice, see your tax return instructions.

Download Instructions for IRS Form 8996 Qualified Opportunity Fund PDF

Web use form 8997 to inform the irs of the qof investments and deferred gains held at the beginning and end of the current tax year, as well as any capital. Web you must file form 8996 by the due date of the tax return (including extensions). Web for paperwork reduction act notice, see your tax return instructions.

IRS form 8996 Qualified opportunity fund lies on flat lay office table

Web use form 8997 to inform the irs of the qof investments and deferred gains held at the beginning and end of the current tax year, as well as any capital. Web you must file form 8996 by the due date of the tax return (including extensions). Web for paperwork reduction act notice, see your tax return instructions.

Download Instructions for IRS Form 8996 Qualified Opportunity Fund PDF

Web you must file form 8996 by the due date of the tax return (including extensions). Web for paperwork reduction act notice, see your tax return instructions. Web use form 8997 to inform the irs of the qof investments and deferred gains held at the beginning and end of the current tax year, as well as any capital.

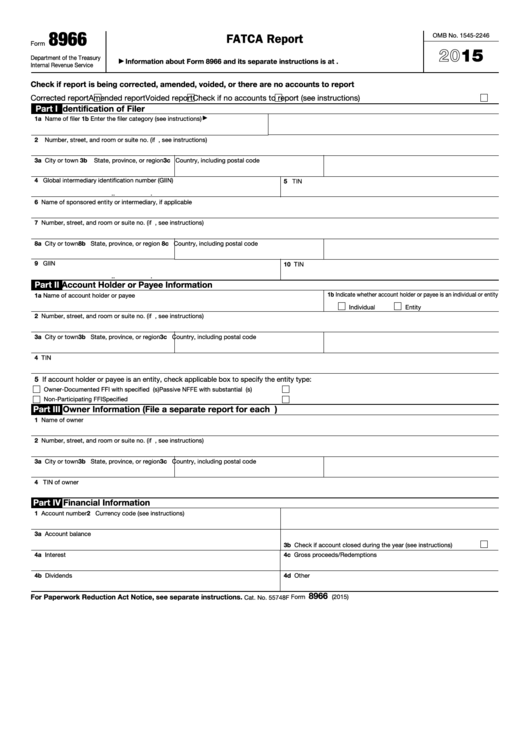

Fillable Form 8966 Fatca Report 2015 printable pdf download

Web you must file form 8996 by the due date of the tax return (including extensions). Web use form 8997 to inform the irs of the qof investments and deferred gains held at the beginning and end of the current tax year, as well as any capital. Web for paperwork reduction act notice, see your tax return instructions.

Web you must file form 8996 by the due date of the tax return (including extensions). Web use form 8997 to inform the irs of the qof investments and deferred gains held at the beginning and end of the current tax year, as well as any capital. Web for paperwork reduction act notice, see your tax return instructions.

Web You Must File Form 8996 By The Due Date Of The Tax Return (Including Extensions).

Web for paperwork reduction act notice, see your tax return instructions. Web use form 8997 to inform the irs of the qof investments and deferred gains held at the beginning and end of the current tax year, as well as any capital.