Fulton County Tax Appeal Form - The supreme court ruling on tads. Web onsite paperless filing onsite paperless filing is now available for your convenience at all our homestead locations. Web appeal of assessment form the state of georgia provides a uniform appeal form for use by property owners. Homestead & special exemptions real property returns (jan. You may appeal your annual notice of assessment by using one of the methods below and you must do so by. File an appeal on the fulton county board of assessors website. The notice of appeal shall be filed. Web specify grounds for appeal: Web this printable was uploaded at august 30, 2023 by tamble in tax. Web appeals may be submitted online at www.fultonassessor.org, by mail, or in the offices of the board of assessors.

Fill Free fillable forms Fulton County Government

The appeals deadline for most. File an appeal on the fulton county board of assessors website. Web tax allocation districts in fulton county. Web superior court the appellant or the county board of tax assessors may appeal decisions of the board of equalization. Web the written appeal is filed initially with the board of tax assessors.

Fulton County Tax Assessment Appeals Process Explained

File an appeal on the fulton county board of assessors website. Web this printable was uploaded at august 30, 2023 by tamble in tax. You will get a letter in the mail responding. All parcels in appeal will be billed at 85% of the assessed value. Web in the initial written dispute, property owners must indicate their preferred method of.

Part 2 how to appeal your property taxes Michelle Hatch Realtor

Web in the initial written dispute, property owners must indicate their preferred method of appeal. Web the appellant or the county board of tax assessors may appeal decisions of the board of equalization. All parcels in appeal will be billed at 85% of the assessed value. Check all that apply exemption denied breach of covenant. Ending tax on tags would.

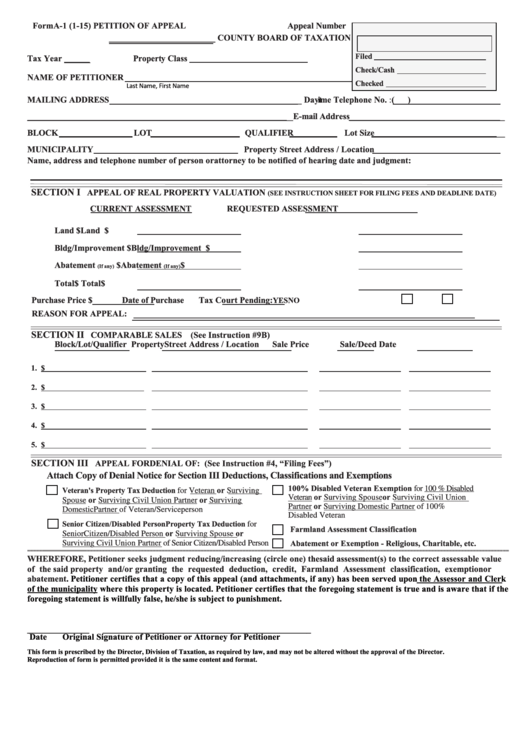

Fillable Form A1 Petition Of Appeal County Board Of Taxation 2015

Web step 1 of 5 assessing your home you will only be able to appeal the assessed value of your home, not your property’s. File an appeal on the fulton county board of assessors website. Web specify grounds for appeal: Web appealing your assessment boards of equalization homestead exemptions boards of equalization 141 pryor street, s.w.,. Web the written appeal.

HB 202 Fulton County Tax Assessors and Its Final Valuation During

You may appeal your annual notice of assessment by using one of the methods below and you must do so by. Web the written appeal is filed initially with the board of tax assessors. Web appeals may be submitted online at www.fultonassessor.org, by mail, or in the offices of the board of assessors. The notice of appeal shall be filed..

Fill Free fillable forms Fulton County Government

File an appeal on the fulton county board of assessors website. Web step 1 of 5 assessing your home you will only be able to appeal the assessed value of your home, not your property’s. The appeals deadline for most. Web this printable was uploaded at august 30, 2023 by tamble in tax. Web the fulton county tax commissioner is.

Atlanta Property Tax Calculator Fulton County. Millage Rate

The appeals deadline for most. Web in the initial written dispute, property owners must indicate their preferred method of appeal. You will get a letter in the mail responding. Web onsite paperless filing onsite paperless filing is now available for your convenience at all our homestead locations. Web this printable was uploaded at august 30, 2023 by tamble in tax.

Fulton County Property Tax Online Payment Property Walls

Web appeal of assessment form the state of georgia provides a uniform appeal form for use by property owners. The county could drop your. Web specify grounds for appeal: The appeals deadline for most. The supreme court ruling on tads.

Fulton County Tax Appeal Forms

Web specify grounds for appeal: You will get a letter in the mail responding. The notice of appeal shall be filed. Web you may only submit them to the state after you have gone through the fulton county board of review. Web tax allocation districts in fulton county.

Fillable Dte Form 4 Notice Of Appeal To The Board Of Tax Appeals

Web step 1 of 5 assessing your home you will only be able to appeal the assessed value of your home, not your property’s. Web superior court the appellant or the county board of tax assessors may appeal decisions of the board of equalization. The notice of appeal shall be filed. Web appeal of assessment form the state of georgia.

Web the fulton county tax commissioner is responsible for the collection of property taxes for fulton county government,. Web tax allocation districts in fulton county. Welcome to the fulton county smartfile site. Web the appellant or the county board of tax assessors may appeal decisions of the board of equalization. Web this printable was uploaded at august 30, 2023 by tamble in tax. Check all that apply exemption denied breach of covenant. The appeals deadline for most. Web superior court the appellant or the county board of tax assessors may appeal decisions of the board of equalization. Web step 1 of 5 assessing your home you will only be able to appeal the assessed value of your home, not your property’s. The notice of appeal shall be filed. Web appeals may be submitted online at www.fultonassessor.org, by mail, or in the offices of the board of assessors. The county could drop your. Web you may only submit them to the state after you have gone through the fulton county board of review. Ending tax on tags would be fairer to all. You will get a letter in the mail responding. Homestead & special exemptions real property returns (jan. Web appealing your assessment boards of equalization homestead exemptions boards of equalization 141 pryor street, s.w.,. To ensure the preservation of your. All parcels in appeal will be billed at 85% of the assessed value. Web in the initial written dispute, property owners must indicate their preferred method of appeal.

Web Superior Court The Appellant Or The County Board Of Tax Assessors May Appeal Decisions Of The Board Of Equalization.

Web you may only submit them to the state after you have gone through the fulton county board of review. Check all that apply exemption denied breach of covenant. Web appeals may be submitted online at www.fultonassessor.org, by mail, or in the offices of the board of assessors. The county could drop your.

Web In The Initial Written Dispute, Property Owners Must Indicate Their Preferred Method Of Appeal.

Web appeal of assessment form the state of georgia provides a uniform appeal form for use by property owners. The appeals deadline for most. Welcome to the fulton county smartfile site. Web the fulton county tax commissioner is responsible for the collection of property taxes for fulton county government,.

Web The Written Appeal Is Filed Initially With The Board Of Tax Assessors.

Web specify grounds for appeal: To ensure the preservation of your. Web onsite paperless filing onsite paperless filing is now available for your convenience at all our homestead locations. Web appealing your assessment boards of equalization homestead exemptions boards of equalization 141 pryor street, s.w.,.

You May Appeal Your Annual Notice Of Assessment By Using One Of The Methods Below And You Must Do So By.

The supreme court ruling on tads. You will get a letter in the mail responding. Web the appellant or the county board of tax assessors may appeal decisions of the board of equalization. The notice of appeal shall be filed.