How Long Does It Take To Process Form 4549 - Web how long does it take to process 4549 form: Web if you do not sign the form 4549, the irs will send you a notice of deficiency. Web we send you a letter saying the audit is closed and then refund the amount due to you within eight weeks. This gives you 90 days to petition tax court. If available, attach a copy. Web chief counsel advice 201921013. Web the irs uses form 4549 when the audit is complete. You don't have to answer my question form 4549 —. Forget about scanning and printing out forms. Web of form 4549 (rev.

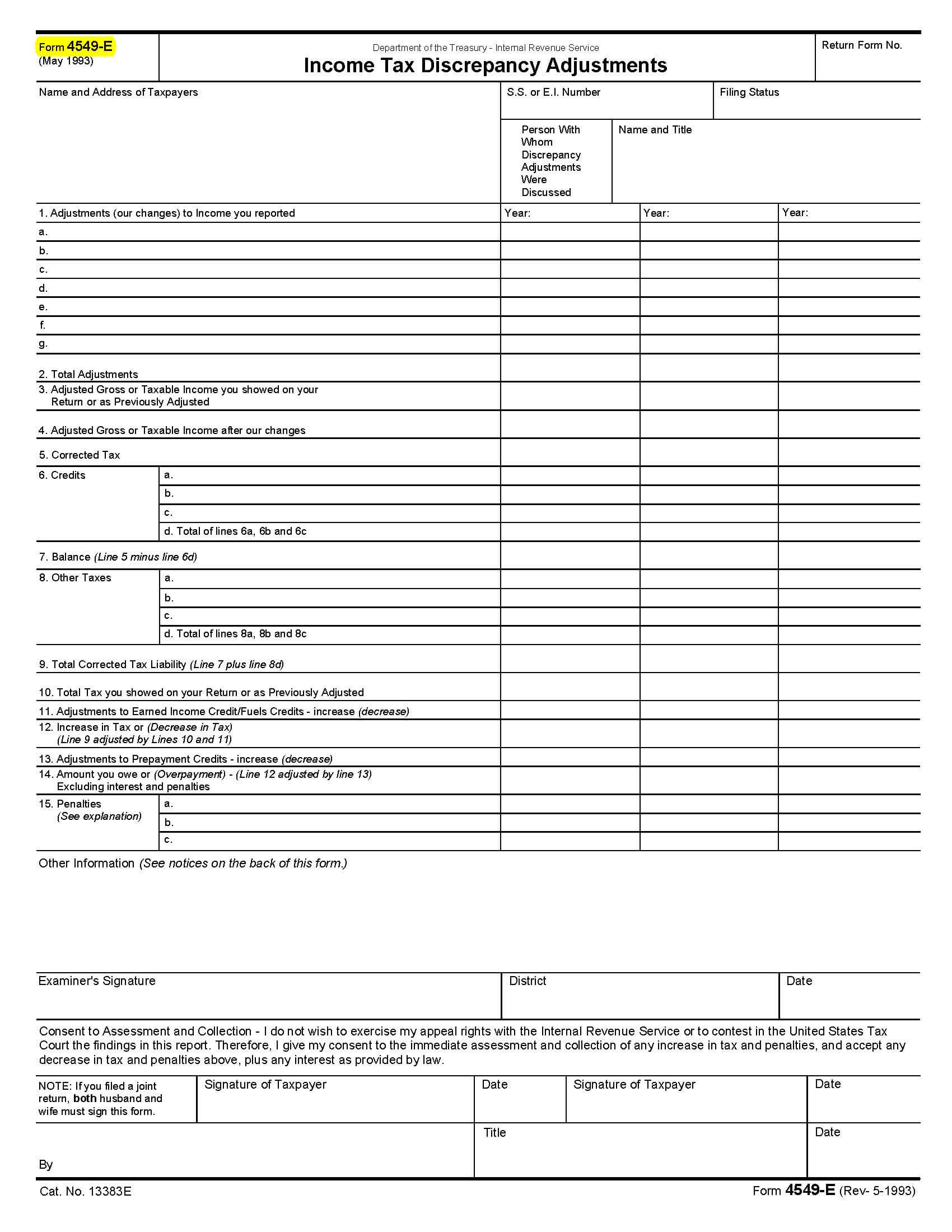

Fillable Form 4549E Tax Discrepancy Adjustments Form

Form 12661, disputed issue verification, is recommended to explain the issues you disagree with. Web we send you a letter saying the audit is closed and then refund the amount due to you within eight weeks. Use our detailed instructions to. Web how long does it take to process form 4549 form 4549 instructions irs form 4549 pdf irs form.

Audit Form 4549 Tax Lawyer Response to IRS Determination

The form will include a summary of the proposed. Use our detailed instructions to. Web we send you a letter saying the audit is closed and then refund the amount due to you within eight weeks. Web how long does it take to process form 4549 form 4549 instructions irs form 4549 pdf irs form 4549 mailing address irs form.

Audit Form 4549 Tax Lawyer Response to IRS Determination

Web follow this guideline to quickly and accurately fill in irs 4549. Web the irs form 4549 is the income tax examination changes letter. Web form 4549, report of income tax examination changes, a report showing the proposed adjustments to your tax. Web chief counsel advice 201921013. Web if you do not respond to form 4549, the irs will send.

Fillable Form 4549E Tax Discrepancy Adjustments Internal

Web quick guide on how to complete irs form 4549 pdf. Forget about scanning and printing out forms. Web depending on how many years were audited, the form can show the results of up to three years of audits. The form will include a summary of the proposed. Web how long does it take to process form 4549 form 4549.

Form 4549 Tax Examination Changes March 2005 printable pdf

Web how long does it take to process 4549 form: Web we send you a letter saying the audit is closed and then refund the amount due to you within eight weeks. Web if you do not sign the form 4549, the irs will send you a notice of deficiency. The notice of deficiency will provide you 90 days. Web.

Form 4549A Tax Discrepancy Adjustments printable pdf download

This gives you 90 days to petition tax court. Web an irs form 4549 is a statement of income tax examination changes. this is merely a proposed adjustment if it is attached to a. Web how long does it take to process form 4549 form 4549 instructions irs form 4549 pdf irs form 4549 mailing address irs form 4549. You.

Form 4549A Tax Examination Changes printable pdf download

This gives you 90 days to petition tax court. Web we send you a letter saying the audit is closed and then refund the amount due to you within eight weeks. Use our detailed instructions to. In chief counsel advice (cca), irs has held that form 4549, income tax. If available, attach a copy.

Form 4549A Tax Examination Changes printable pdf download

Web an irs form 4549 is a statement of income tax examination changes. this is merely a proposed adjustment if it is attached to a. In chief counsel advice (cca), irs has held that form 4549, income tax. But there are certain times when they are more likely to use. Web of form 4549 (rev. Web how long does it.

Form 4549A Tax Discrepancy Adjustments printable pdf download

If available, attach a copy. But there are certain times when they are more likely to use. Web depending on how many years were audited, the form can show the results of up to three years of audits. Web the irs audit reconsideration is an option you must explore if the irs has made an assessment based on your return.

Form 4549B Tax Examitation Changes printable pdf download

Web we send you a letter saying the audit is closed and then refund the amount due to you within eight weeks. The notice of deficiency will provide you 90 days. Web the irs audit reconsideration is an option you must explore if the irs has made an assessment based on your return and imposed an additional tax. How you.

This gives you 90 days to petition tax court. Web an irs form 4549 is a statement of income tax examination changes. this is merely a proposed adjustment if it is attached to a. Web if you do not sign the form 4549, the irs will send you a notice of deficiency. The irs estimates that taxpayers who file for audit. How you can submit the irs 4549 on the internet: The form also shows any. In chief counsel advice (cca), irs has held that form 4549, income tax. Web how long does it take to process 4549 form: Web depending on how many years were audited, the form can show the results of up to three years of audits. Web we send you a letter saying the audit is closed and then refund the amount due to you within eight weeks. Web changes you want us to consider. Web chief counsel advice 201921013. Web the irs form 4549 is the income tax examination changes letter. Web the irs audit reconsideration is an option you must explore if the irs has made an assessment based on your return and imposed an additional tax. I was audited for 2019 taxes and they finally determined. Web follow this guideline to quickly and accurately fill in irs 4549. If available, attach a copy. Web of form 4549 (rev. Web quick guide on how to complete irs form 4549 pdf. Web how long does it take to process form 4549 form 4549 instructions irs form 4549 pdf irs form 4549 mailing address irs form 4549.

Web Quick Guide On How To Complete Irs Form 4549 Pdf.

Web how long does it take to process 4549 form: If available, attach a copy. Use our detailed instructions to. Web the irs uses form 4549 when the audit is complete.

Web Form 4549, Report Of Income Tax Examination Changes, A Report Showing The Proposed Adjustments To Your Tax.

Web chief counsel advice 201921013. Web changes you want us to consider. Web if you do not sign the form 4549, the irs will send you a notice of deficiency. Web we send you a letter saying the audit is closed and then refund the amount due to you within eight weeks.

How You Can Submit The Irs 4549 On The Internet:

Web follow this guideline to quickly and accurately fill in irs 4549. The notice of deficiency will provide you 90 days. The form will include a summary of the proposed. Web depending on how many years were audited, the form can show the results of up to three years of audits.

Web Hi, 2 Weeks Ago I Faxed Form 4549 Back To The Irs At The Number Provided.

Web of form 4549 (rev. The form also shows any. I was audited for 2019 taxes and they finally determined. Web the irs form 4549 is the income tax examination changes letter.