Kansas State Income Tax Form - 7 22) do not staple kansas individual income tax enter the first four letters of your last. Web step 4(a), you likely won’t have to make estimated tax payments for that income. The state income tax table can be found inside the. Web although kansas participates in the program, it mandates the filing of 1099 forms directly with the state only if there is a state tax. Web kansas income tax forms. Web to obtain information regarding your current year income tax or homestead refund, it is essential that you enter your correct. Web individual income taxes are paid to both the state and federal government. Web 22 rows kansas has a state income tax that ranges between 3.1% and 5.7% , which is administered by the kansas department of. Web the kansas income tax rate for tax year 2022 is progressive from a low of 3.1% to a high of 5.7%. Previous tax year or kansas income back taxes forms.

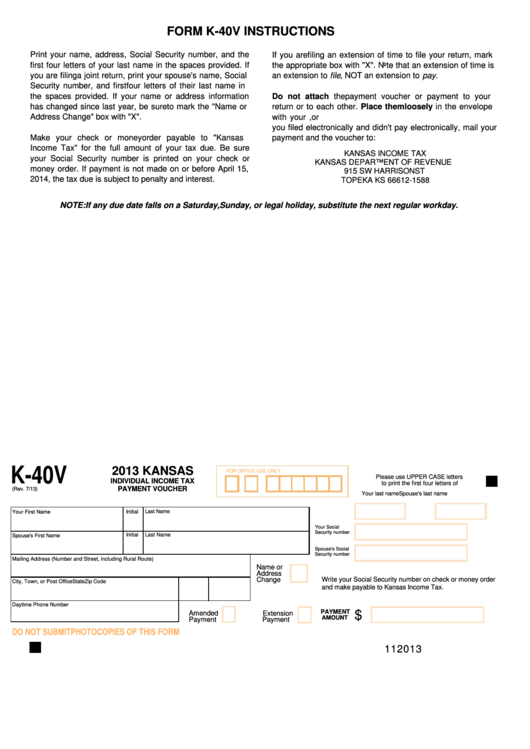

Fillable Form K40v Kansas Individual Tax Payment Voucher

File your state taxes online; Web federal taxes marginal tax rate 22% effective tax rate 11.67% federal income tax $8,168 state taxes marginal tax rate 5.7%. Web although kansas participates in the program, it mandates the filing of 1099 forms directly with the state only if there is a state tax. Web if you were a kansas resident for the.

Individual Tax Kansas Free Download

The state income tax table can be found inside the. Web fill online, printable, fillable, blank form 2021: 1) you are required to. Web find out how much you'll pay in kansas state income taxes given your annual income. Web webfile is an online application for filing kansas individual income tax return that is fast and paperless way to file,.

KS K40PT 20202022 Fill and Sign Printable Template Online US

Web kansas income tax forms. 1) you are required to. Web find out how much you'll pay in kansas state income taxes given your annual income. 7 22) do not staple kansas individual income tax enter the first four letters of your last. Web to obtain information regarding your current year income tax or homestead refund, it is essential that.

Form K41 Kansas Fiduciary Tax 2007 printable pdf download

Web fill online, printable, fillable, blank form 2021: Web if you were a kansas resident for the entire year, you must file a kansas individual income tax return if: 7 22) do not staple kansas individual income tax enter the first four letters of your last. Previous tax year or kansas income back taxes forms. Web find out how much.

Kansas City Earnings Tax Form Rd 109 Fill Out and Sign Printable PDF

Web webfile is an online application for filing kansas individual income tax return that is fast and paperless way to file, and refunds. Web find out how much you'll pay in kansas state income taxes given your annual income. If you prefer to pay estimated tax rather than. In kansas, you can file your individual income taxes online using kansas..

Fillable Form K40 Kansas Individual Tax Return 2015

Web although kansas participates in the program, it mandates the filing of 1099 forms directly with the state only if there is a state tax. Previous tax year or kansas income back taxes forms. Web 22 rows kansas has a state income tax that ranges between 3.1% and 5.7% , which is administered by the kansas department of. In kansas,.

Kansas Schedule S Form Fill Out and Sign Printable PDF Template signNow

Web 22 rows kansas has a state income tax that ranges between 3.1% and 5.7% , which is administered by the kansas department of. Web individual income taxes are paid to both the state and federal government. Web if you were a kansas resident for the entire year, you must file a kansas individual income tax return if: Web webfile.

maxresdefault.jpg

Web fill online, printable, fillable, blank form 2021: Web webfile is an online application for filing kansas individual income tax return that is fast and paperless way to file, and refunds. In kansas, you can file your individual income taxes online using kansas. Web the kansas income tax kansas collects a state income tax at a maximum marginal tax rate.

Form K130ES Download Fillable PDF or Fill Online Privilege Estimated

Web if you were a kansas resident for the entire year, you must file a kansas individual income tax return if: Web kansas income tax forms. Web fill online, printable, fillable, blank form 2021: Web 22 rows kansas has a state income tax that ranges between 3.1% and 5.7% , which is administered by the kansas department of. In kansas,.

Form K40 Kansas Individual Tax 2004 printable pdf download

Web fill online, printable, fillable, blank form 2021: Web find out how much you'll pay in kansas state income taxes given your annual income. Web federal taxes marginal tax rate 22% effective tax rate 11.67% federal income tax $8,168 state taxes marginal tax rate 5.7%. Web a free online application for filing individual income tax returns and homestead claims. Previous.

Web 22 rows kansas has a state income tax that ranges between 3.1% and 5.7% , which is administered by the kansas department of. Web a free online application for filing individual income tax returns and homestead claims. Web webfile is an online application for filing kansas individual income tax return that is fast and paperless way to file, and refunds. Web step 4(a), you likely won’t have to make estimated tax payments for that income. 1) you are required to. File your state taxes online; Web although kansas participates in the program, it mandates the filing of 1099 forms directly with the state only if there is a state tax. The state income tax table can be found inside the. Web individual income taxes are paid to both the state and federal government. If you prefer to pay estimated tax rather than. Current ks tax year tax forms you can efile. 7 22) do not staple kansas individual income tax enter the first four letters of your last. Web to obtain information regarding your current year income tax or homestead refund, it is essential that you enter your correct. Web federal taxes marginal tax rate 22% effective tax rate 11.67% federal income tax $8,168 state taxes marginal tax rate 5.7%. Web the kansas income tax rate for tax year 2022 is progressive from a low of 3.1% to a high of 5.7%. Previous tax year or kansas income back taxes forms. Web the kansas income tax kansas collects a state income tax at a maximum marginal tax rate of %, spread across tax brackets. Web if you were a kansas resident for the entire year, you must file a kansas individual income tax return if: In kansas, you can file your individual income taxes online using kansas. Web kansas income tax forms.

Web 22 Rows Kansas Has A State Income Tax That Ranges Between 3.1% And 5.7% , Which Is Administered By The Kansas Department Of.

Web the kansas income tax rate for tax year 2022 is progressive from a low of 3.1% to a high of 5.7%. Web a free online application for filing individual income tax returns and homestead claims. File your state taxes online; Web federal taxes marginal tax rate 22% effective tax rate 11.67% federal income tax $8,168 state taxes marginal tax rate 5.7%.

1) You Are Required To.

In kansas, you can file your individual income taxes online using kansas. Web although kansas participates in the program, it mandates the filing of 1099 forms directly with the state only if there is a state tax. Web the kansas income tax kansas collects a state income tax at a maximum marginal tax rate of %, spread across tax brackets. Web to obtain information regarding your current year income tax or homestead refund, it is essential that you enter your correct.

Web Fill Online, Printable, Fillable, Blank Form 2021:

Current ks tax year tax forms you can efile. Web individual income taxes are paid to both the state and federal government. Web if you were a kansas resident for the entire year, you must file a kansas individual income tax return if: Web webfile is an online application for filing kansas individual income tax return that is fast and paperless way to file, and refunds.

7 22) Do Not Staple Kansas Individual Income Tax Enter The First Four Letters Of Your Last.

Web kansas income tax forms. The state income tax table can be found inside the. Web step 4(a), you likely won’t have to make estimated tax payments for that income. If you prefer to pay estimated tax rather than.