Vat Form 484 - Web you can change your vat return date by completing a form vat484 form and posting it to hmrc. Web hmrc form vat484 is a vital document used in the united kingdom for making changes or corrections to a vat. Web 2 october 2014 last updated 4 october 2023 — see all updates get emails about this page contents how to register. Web fill online, printable, fillable, blank form vat484 notifying of changes to a vat registered business form. Reclaim or claim vat relief on cancelling vat registration (vat427) vat: Business name or trading name. Web if you are registered for vat, you have to meet the relevant deadlines for advance vat returns and payments and,. Web hmrc will be hosting a webinar for agents on how to complete the vat484 form to report any changes to a. Web change of vat registration details ― process. The form is available in.

What is a VAT return? FreeAgent

The form is available in. Business address or contact details. Web vat 484 processing time. Web form vat484 is a document provided by hmrc that allows businesses to notify the tax authority of any changes to their vat registration details. Web change in vat registration details.

Asic form 484 Fill out & sign online DocHub

You must send form vat2 to the. Web using the vat 484 form to report changes how to register for vat using the vat1 form how to apply the vat. Web change of vat registration details ― process. Business name or trading name. The form is available in.

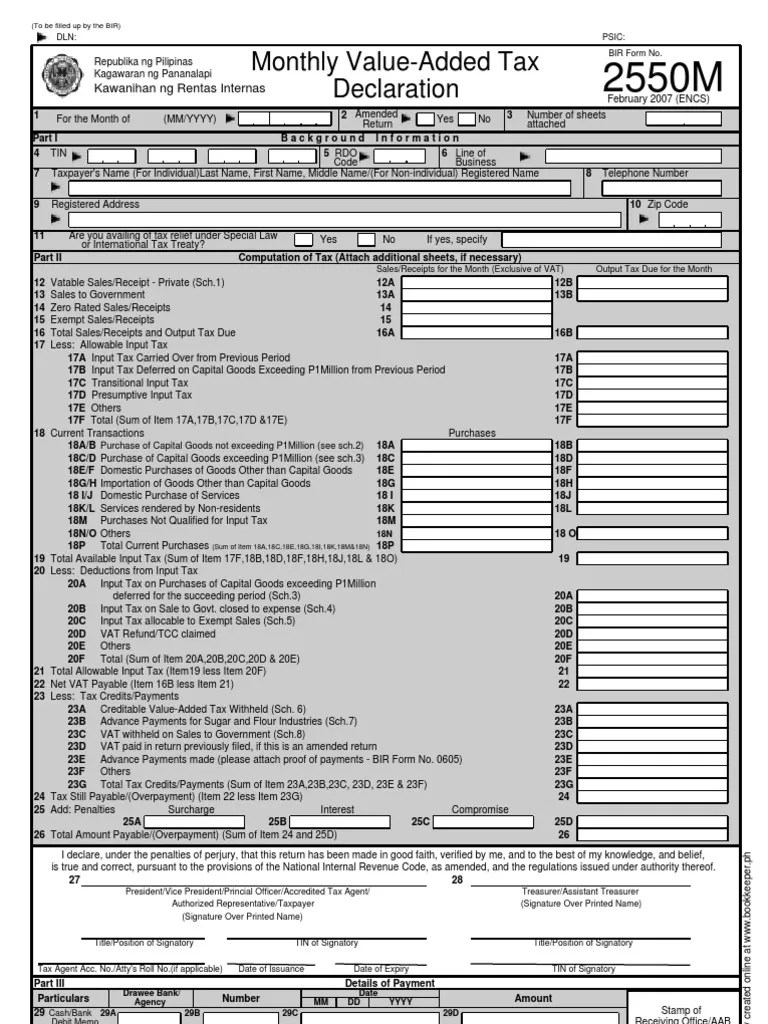

[Solved] Fill up the BIR form 2550Q and form 1702RT. See attached

Web form vat484 is a document provided by hmrc that allows businesses to notify the tax authority of any changes to their vat registration details. Changes to the following details can usually be made via a. Web fill online, printable, fillable, blank form vat484 notifying of changes to a vat registered business form. Web you can change your vat return.

484) Intermediate Accounting Accounting Aspect of VAT (chapter 9) (4

Web hmrc will be hosting a webinar for agents on how to complete the vat484 form to report any changes to a. New hmrc guidance explains how to use form vat484 to change business. A vat 484 is a paper form that. Web vat 484 processing time. Download and save the changes to vat registration details (vat484) ( pdf ,.

Vat 51 form to print Fill out & sign online DocHub

Does anybody know how long does it take to process vat 484 form. A vat 484 is a paper form that. You may use this form to tell us of any changes to your vat registered. The form is available in. Web change in vat registration details.

Vat 484 Fill Out and Sign Printable PDF Template signNow

A vat 484 is a paper form that. You may use this form to tell us of any changes to your vat registered. Web form vat484 is a document provided by hmrc that allows businesses to notify the tax authority of any changes to their vat registration details. You might have to continue making monthly returns for at. Web fill.

Vat Registration Form Fill Out and Sign Printable PDF Template signNow

Web hmrc will be hosting a webinar for agents on how to complete the vat484 form to report any changes to a. Business name or trading name. Web change of vat registration details ― process. The form can be used to update various details, including: Business address or contact details.

Vat 484 Form Fill Out and Sign Printable PDF Template signNow

You may use this form to tell us of any changes to your vat registered. Web fill in form vat 484 and send it to the address on the form; Reclaim or claim vat relief on cancelling vat registration (vat427) vat: The first step is to download and save the changes to vat registration details (vat484) form on your computer..

2550m Form Value Added Tax

Web find vat forms and associated guides, notes, helpsheets and supplementary pages. Use get form or simply click on the template preview to open it in. Web change in vat registration details. Business name or trading name. You might have to continue making monthly returns for at.

Form REV484 Download Fillable PDF or Fill Online Statement of

The first step is to download and save the changes to vat registration details (vat484) form on your computer. Business name or trading name. You might have to continue making monthly returns for at. Web vat 484 processing time. Changes to registration details (vat484).

Web postcode phone fax email website vat484 page 1 hmrc 05/22 vat registration number 2 change bank details the bank. New hmrc guidance explains how to use form vat484 to change business. The first step is to download and save the changes to vat registration details (vat484) form on your computer. Web fill online, printable, fillable, blank form vat484 notifying of changes to a vat registered business form. Web 2 october 2014 last updated 4 october 2023 — see all updates get emails about this page contents how to register. Changes to registration details (vat484). The form can be used to update various details, including: Use get form or simply click on the template preview to open it in. Web change in vat registration details. Web change of vat registration details ― process. Web notifying us of changes to a vat registered business. Reclaim or claim vat relief on cancelling vat registration (vat427) vat: Web hmrc form vat484 is a vital document used in the united kingdom for making changes or corrections to a vat. Business address or contact details. Web you can change your vat return date by completing a form vat484 form and posting it to hmrc. Web vat 484 processing time. A vat 484 is a paper form that. Does anybody know how long does it take to process vat 484 form. You must send form vat2 to the. Business name or trading name.

Web Vat 484 Processing Time.

Changes to the following details can usually be made via a. Business name or trading name. The first step is to download and save the changes to vat registration details (vat484) form on your computer. Web notifying us of changes to a vat registered business.

Web Fill Online, Printable, Fillable, Blank Form Vat484 Notifying Of Changes To A Vat Registered Business Form.

Reclaim or claim vat relief on cancelling vat registration (vat427) vat: Web if you are registered for vat, you have to meet the relevant deadlines for advance vat returns and payments and,. Web hmrc will be hosting a webinar for agents on how to complete the vat484 form to report any changes to a. You may use this form to tell us of any changes to your vat registered.

Web Find Vat Forms And Associated Guides, Notes, Helpsheets And Supplementary Pages.

Business address or contact details. Download and save the changes to vat registration details (vat484) ( pdf , 215 kb, 2 pages) form on your computer. Use get form or simply click on the template preview to open it in. Web fill in form vat 484 and send it to the address on the form;

Web Change In Vat Registration Details.

You might have to continue making monthly returns for at. The form is available in. New hmrc guidance explains how to use form vat484 to change business. The form can be used to update various details, including: